Everything You Need to Learn About Cash Loan and the Benefits of a Payday Lending

Cash loan and cash advance lendings are preferred economic tools for those encountering immediate cash scarcities. These alternatives supply fast accessibility to funds, however they likewise come with substantial dangers. Comprehending their effects and technicians is crucial for anybody thinking about these courses. Before making a choice, it is vital to check out both the benefits and potential challenges. What choices might much better serve long-lasting financial wellness?

What Is a Cash loan?

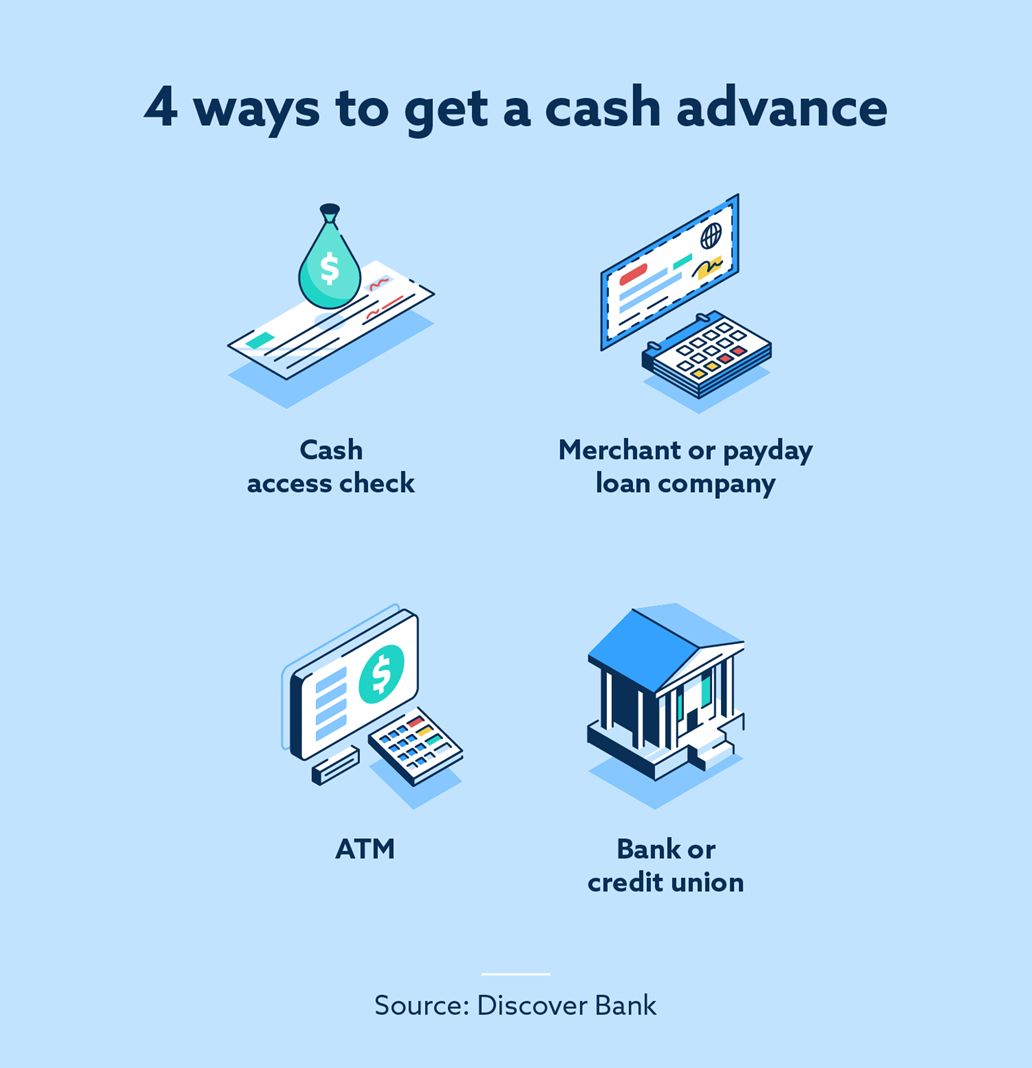

A cash loan is a temporary finance that permits people to access funds quickly, normally through charge card or personal loans. This monetary device supplies immediate liquidity when unanticipated costs arise, such as clinical expenses or automobile repairs. Unlike traditional fundings, cash loan usually need marginal documentation, enabling faster approval and dispensation. They can be gotten at Atm machines or with bank card issuers, making them available in immediate situations.

Nonetheless, debtors need to realize that cash loan usually feature greater rates of interest contrasted to regular credit history card acquisitions. In addition, fees might use, which can build up swiftly if the balance is not repaid promptly. As a result, while cash loan can be a practical remedy for immediate cash money demands, individuals must thoroughly consider their financial situation to prevent prospective challenges related to high costs and settlement obstacles.

Understanding Payday Loans

Payday advance loan are temporary financial products developed to give fast money to consumers in demand. These finances generally require settlement by the following cash advance and feature details qualification criteria that possible borrowers should meet. Understanding just how payday advance loans work and their demands is necessary for anybody considering this kind of financial support.

Interpretation of Cash Advance Loans

Just how They Work

While checking out the mechanics of payday advance loan, it becomes clear that these monetary products operate on an uncomplicated facility. Debtors looking for fast money can obtain a short-term funding, normally due on their next income. The procedure typically includes a straightforward application, where the borrower offers evidence of revenue and recognition. Upon authorization, the loan provider provides the financing amount, frequently come with by a cost based upon the borrowed sum. Repayment happens immediately when the consumer obtains their paycheck, with the lending institution subtracting the owed amount straight from their bank account. This benefit allures to those facing unanticipated expenditures. Debtors need to be cautious, as high rate of interest rates can lead to a cycle of debt if not taken care of thoroughly.

Qualification Requirements Clarified

To get a cash advance, customers have to fulfill certain qualification requirements that loan providers normally need. First, candidates have to go to least 18 years old and have a legitimate government-issued identification. A constant resource of income is likewise essential, as lenders need guarantee that debtors can repay the lending. This revenue can originate from employment, social safety, or various other consistent sources. Additionally, consumers should have an active bank account, which permits the direct deposit of funds and automatic withdrawal for payment. While credit history checks might differ by loan provider, lots of cash advance finance providers do not prioritize credit history, concentrating rather on revenue stability and payment ability. Comprehending these requirements helps candidates browse the payday advance procedure efficiently.

How Cash Advances and Payday Loans Work

Money advances and cash advance fundings operate as quick monetary options created to resolve prompt cash money circulation demands. Usually, individuals request these lendings through banks or on the internet systems, submitting fundamental individual and monetary details. Approval processes are frequently fast, often offering funds within hours.

A cash loan allows customers to access a portion of their credit rating card restriction as cash. The customer incurs rate of interest and fees, commonly at a higher price than standard acquisitions, which accumulates till settlement.

In comparison, payday advance loan are temporary fundings, commonly due on the debtor's next payday. The quantity borrowed is generally little, meant to cover unexpected expenses up until the next paycheck. Debtors accept settle the funding quantity plus charges on the defined due day. Both options are generally meant for emergency situation usage, highlighting the relevance of recognizing the terms and potential effects prior to devoting to either financial item.

Advantages of Using Money Breakthroughs and Payday Loans

Accessing money advances and payday loans can supply several advantages for people facing immediate economic demands. One key advantage is the rate of authorization and financing; debtors commonly obtain funds within a day, minimizing prompt economic stress. These fundings commonly need minimal documentation, making them obtainable even for those with less-than-perfect credit rating. The application process is generally straightforward, enabling individuals to safeguard funds without substantial documentation or prolonged waiting durations.

In addition, cash loan and payday advance loan can help cover unanticipated expenditures, such as clinical bills or vehicle repair services, protecting against the demand for pricey hold-ups. Several lending institutions additionally offer flexible settlement options, permitting consumers to handle their finances a lot more efficiently. Inevitably, these monetary products can function as an essential lifeline, ensuring that individuals can browse via tough situations with loved one ease and confidence.

Important Considerations Before Taking a Funding

Prior to obtaining a cash loan or payday advance, it is necessary to understand the car loan terms and conditions. Fast Cash. In addition, individuals should examine their capability to repay the financing to avoid potential economic pressure. Discovering different options might additionally offer more More Info positive services to their economic needs

Understand Car Loan Terms

Recognizing finance terms is vital for any individual thinking about a cash loan or cash advance, as these agreements commonly consist of complex problems that can greatly influence repayment. Consumers need to pay attention to the rates of interest, which can vary significantly between lending institutions and influence the overall quantity owed. Additionally, recognizing the costs connected with the financing is necessary, as surprise click for more costs can escalate the expense suddenly. Financing period is one more critical facet; recognizing when payments are due assists prevent fines. Clarity on the repercussions of skipping can prevent future monetary pressure. By thoroughly comprehending these terms, customers can make informed choices and browse the lending landscape extra properly. Recognition of such details is vital to effective borrowing.

Analyze Payment Capability

Assessing settlement ability is vital for anyone taking into consideration a cash loan or cash advance loan. Borrowers need to examine their present financial circumstance, including revenue, costs, and any type of current financial debts. Recognizing monthly capital enables people to establish if they can conveniently meet settlement terms without sustaining additional economic pressure. It is also important to variable in unexpected costs that might occur throughout the funding period. By realistically estimating the ability to repay, borrowers can avoid dropping into a cycle of financial obligation or default. Furthermore, taking into consideration potential adjustments in employment or various other earnings sources is vital. Eventually, a comprehensive analysis of settlement ability assists consumers make informed choices and choose funding choices that straighten with their monetary stability.

Discover Alternatives First

While cash money developments and cash advance financings might appear like fast solutions to financial requirements, exploring alternatives is necessary for consumers looking for sustainable options. Cash Loans. Prior to committing to high-interest loans, people must take into consideration different options that may minimize their monetary stress. Options such as working out settlement strategies with lenders, looking for support from neighborhood charities, or making use of community resources can supply immediate relief without accruing financial obligation. Furthermore, borrowing from friends or family members might supply much more positive terms. For those with a steady earnings, applying for a personal finance from a cooperative credit union or bank could yield lower rate of interest. Eventually, exploring these alternatives can bring about much better monetary results and stay clear of the mistakes connected with payday advance and cash loan

Alternatives to Cash Loan and Payday Loans

A number of alternatives may provide even more manageable alternatives when individuals locate themselves in demand of quick cash money however desire to stay clear of the high fees linked with cash breakthroughs and cash advance fundings. One popular option is an individual financing from a cooperative credit see it here union or financial institution, which generally uses lower rate of interest and even more versatile payment terms. An additional option is borrowing from buddies or household, which can remove interest totally and offer a much more lenient settlement schedule.

Furthermore, individuals might take into consideration a side job or freelance work to produce added income, enabling them to fulfill their monetary needs without resorting to high-cost fundings. Selling extra things can likewise give a quick money increase. Some might discover community help programs or regional charities that offer financial assistance for those in need. These choices can often supply a much safer and much more sustainable means to deal with temporary financial emergency situations.

Frequently Asked Questions

Are Cash Money Breakthroughs and Payday Loans the Very Same Point?

Cash loan and cash advance are not the exact same. Cash developments commonly involve loaning against a bank card limit, while payday advance are short-term finances based upon revenue, typically with higher rate of interest and fees.

How Quickly Can I Obtain Funds From a Payday Advance?

Funds from a payday finance can typically be obtained within one service day, although some loan providers might offer same-day financing. The specific timing commonly depends on the lender's plans and the applicant's financial institution.

What Happens if I Can't Repay My Payday Advance Loan in a timely manner?

If a borrower can not repay a payday advance loan on time, they may incur additional fees, face boosted rate of interest, and potentially damage their credit rating. Lenders might also seek collections, impacting the borrower's financial stability.

Can I Obtain a Cash Money Advance With Bad Credit Rating?

Yes, individuals with bad credit scores can still obtain a cash loan. They may encounter higher charges or passion rates, and lending institutions might enforce stricter terms due to regarded danger connected with their credit rating background.

Exist Any Kind Of Costs Connected With Cash Money Advancements?

Yes, cash loan normally involve numerous costs, which may include deal costs, passion costs, and extra service charges. These prices can substantially raise the complete amount owed otherwise taken care of very carefully by the debtor.

A cash breakthrough is a short-term car loan that allows people to gain access to funds swiftly, typically via credit history cards or personal loans. These lendings are normally small, short-duration lendings that debtors are anticipated to settle by their following payday. In comparison, cash advance lendings are short-term lendings, generally due on the customer's following cash advance. Before taking out a cash money breakthrough or payday loan, it is necessary to comprehend the finance terms and problems. Understanding funding terms is important for anyone thinking about a money advance or cash advance funding, as these contracts typically include intricate conditions that can greatly impact settlement.